Sun, sand, surf, and mountains; while the Golden State is known for its beautiful climate and sceneries, it has also become famous for being a state that requires some form of motor vehicle. In guides that help individuals move to California, "come with a car" or "get a car" is almost necessary for building a comfortable life there. Thus, California has the highest number of around 45.7 billion registered automobiles and motor vehicles overall in 2022-2023. Consequently, California is also the home to the most significant number of motor vehicle dealers. With the market for automobiles and motor vehicles still expanding, many see an opportunity to become a new or retail car dealer. However, the state has strict laws regulating the automobile industry. Specifically, under the California Code of Regulations, Title 13, Chapter 1, any person who sells more than five vehicles for profit in California must obtain the relevant auto dealer license from the California Department of Motor Vehicles, Occupational Licensing. You need a California motor vehicle surety bond based on Section 11710 of the Vehicle Code to obtain the license. SuretyNow will introduce the surety company, the bond type, the bond cost, and other necessary information related to the California auto dealer bond to get you started!

The most common bond within the California auto dealer bond is a $50,000 motor vehicle dealer bond, which starts at $300 per year. You will need a $10k wholesale dealer bond if you're a wholesaler.

Requiring a car dealer bond adds a layer of protection to the consumers, the governmental agencies, and the financial agencies with a high auto dealer bond cost and severe legal as well as financial consequences for violating ethical business practices. In other words, paying a fee to regulate dealers' conduct is mandatory, and the car dealer bond can help entities recover from financial losses due to potential unethical activities.

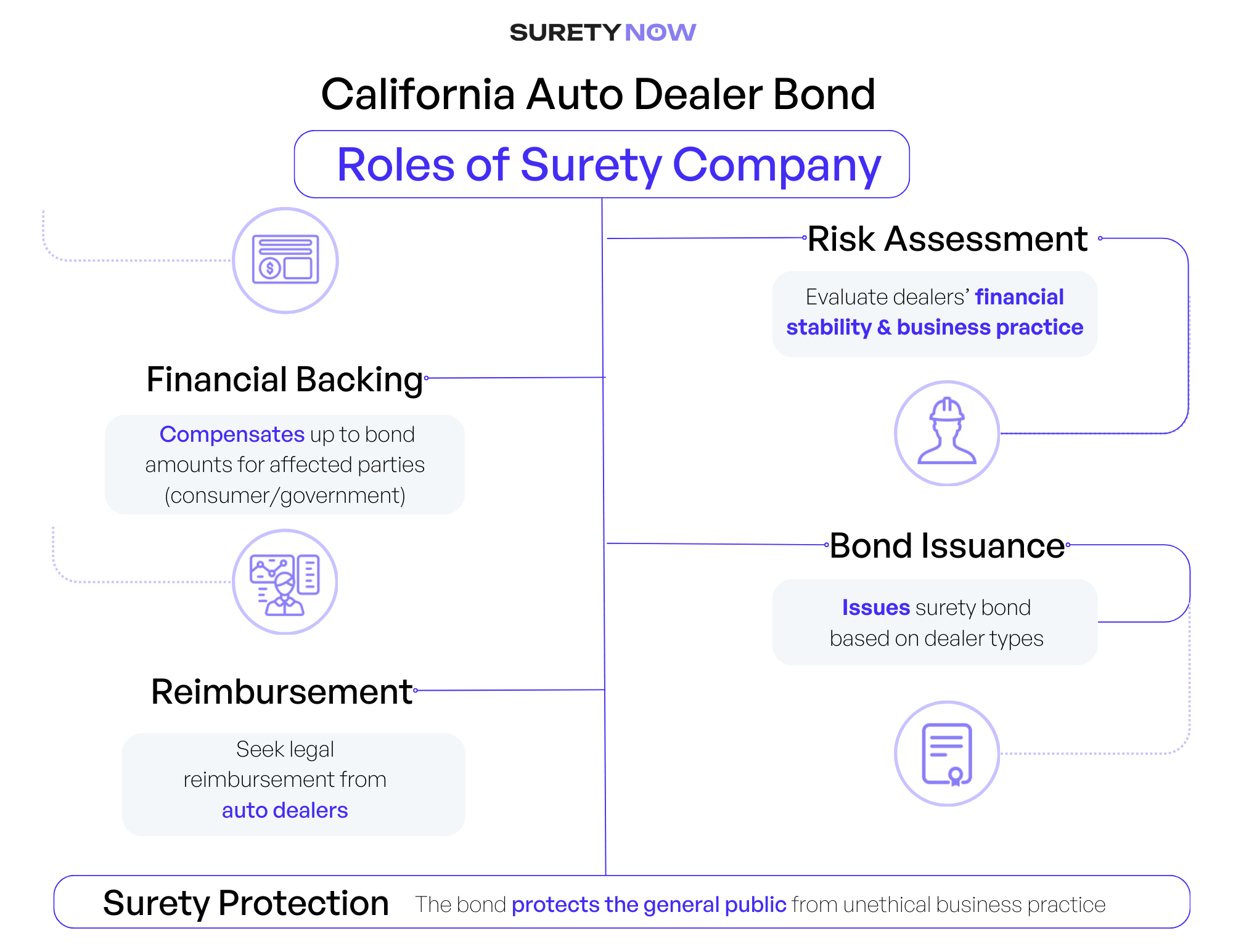

For the bonding process, the surety company is very crucial. The surety companies would be responsible for a series of actions in evaluating and issuing California auto dealer bonds.

The surety company assesses the risk of providing a car dealer bond to a California motor vehicle dealer. This step involves evaluating the dealer's financial stability, business practices, and adherence to state regulations.

Once the surety company determines that the California motor vehicle dealer is a suitable candidate, it issues an auto dealer surety bond. The California Department of Motor Vehicles sets the bond amount based on different dealer types. The bond is a financial guarantee for the dealer's compliance with industry regulations.

The bond is a legal agreement between three parties:

a. The Principal: The auto dealer purchasing the bond.

b. The Obligee: The state of California that requires the bond.

c. The Surety: The company providing the bond.

Suppose the auto dealer fails to comply with state regulations, engages in fraudulent activities, or violates the bond terms. In that case, the surety company is responsible for compensating up to the bond amount for the financial losses of affected parties. The affected parties may be consumers of governmental entities. In the process, the surety company would also investigate the claim associated with the auto dealer to evaluate the circumstance fully.

After settling a claim and compensating the third party, the surety company would seek legal reimbursement from the auto dealer for the amount paid out. This legal process reinforces the financial responsibility of the dealer and encourages compliance with regulations.

No, you only need one bond for multiple operations. You would need the bond with a more considerable sum. For example, suppose you sell motorcycles and used motor vehicle dealers to regular citizens (not licensed dealers). In that case, you need to purchase the $50,000 since it is higher coverage than the $10,000 motorcycle bond.

You only need one bond for as many locations as you have. For example, a used dealership with one location needs the same $50,000 bond as a dealership with ten locations.

The bond protects California consumers from the potential fraudulent acts of unscrupulous bonded auto dealers. Some of the unethical acts include the following:

If any unethical practices exist, a customer can file a claim against the bond.

The CA Auto Dealer Bond needs to have its bond term consistent with the CA Auto Dealer License. Since the CA Auto Dealer License is renewed annually, the bond typically is only for a one-year term and is renewed annually.

To ensure the DMV accepts your bond, you can do a few things:

A credit score is the most critical determinant of the bond price you can control. Having a good credit score can lower the price of your bond significantly. There are a few things you can do to improve your credit score.

Given that the state DMV accepts electronic versions of the bond, you can receive the bond within 30 minutes after bond purchase. We will email a fully signed bond to your email inbox. All you need to do is sign your bond and submit it to the CA DMV.

Even though the Occupational Licensing Branch of the Licensing Operations Division of the CA DMV has its address indicated on the top left of the bond form, you should submit your bond electronically through the Occupational Licensing Login.

There are many steps in the CA Auto Dealer License application process. We have defined the steps below, where obtaining a dealer bond is step 13. However, to obtain an excellent rate for your dealer bond, you can also obtain it as soon as you have a business name. All we need to secure you a rate for your bond is your social security number and a valid dealership name. The sooner you lock down an affordable bond rate, the more peace of mind you have.

A hard copy of your bond is optional for your CA Auto Dealer Bond application. The bond we email you is the final bond with an electronic signature and digital seal. All you need is to print out the bond we emailed you and submit the bond we emailed you to the Occupational Licensing Branch of the Licensing Operations Division of the CA DMV.

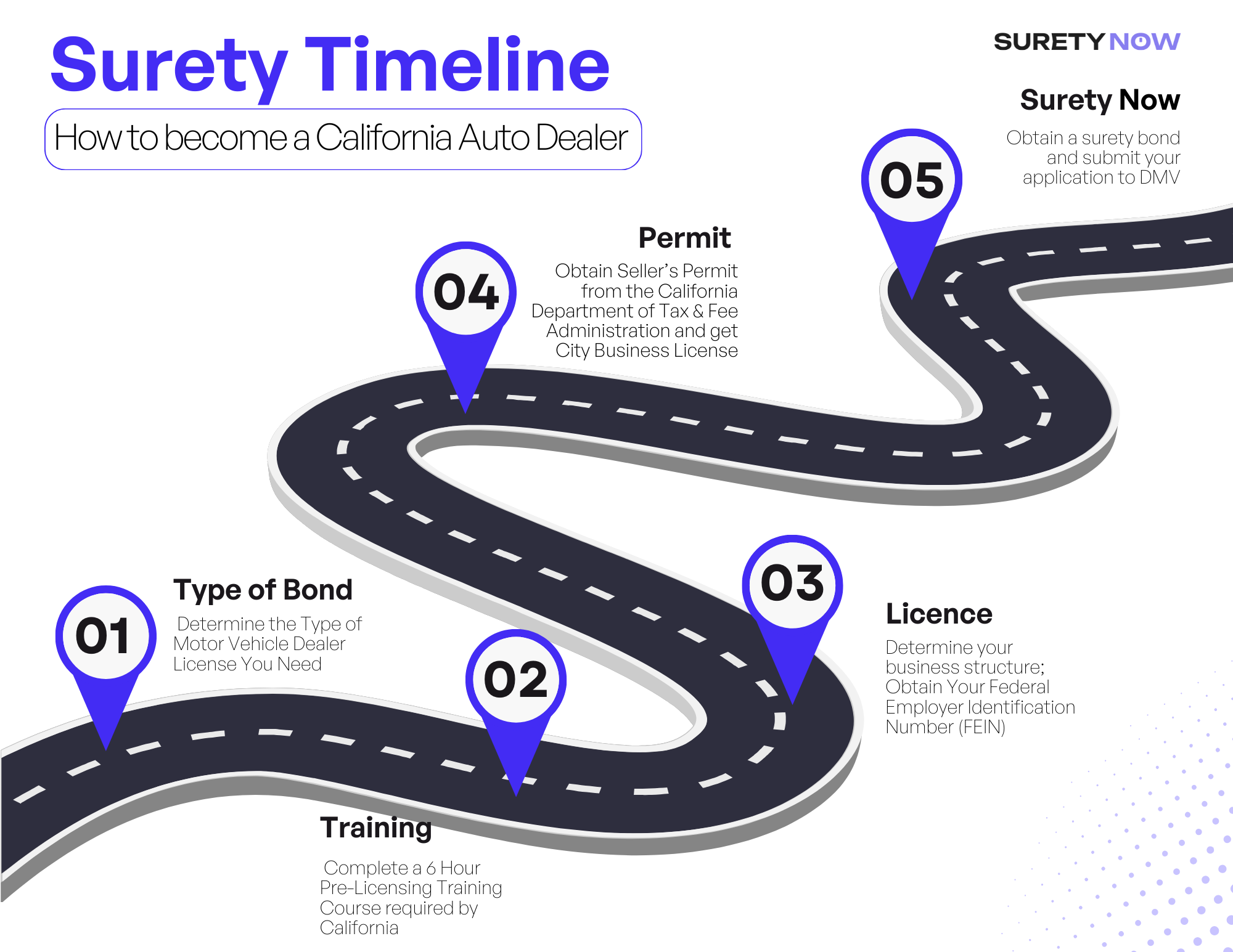

FYI, we have an in-depth guide on how to become a CA auto dealer. But here are the abbreviated steps.

Step 1: Determine the Type of Motor Vehicle Dealer License You Need

Step 2: Complete a 6 Hour Pre-Licensing Training Course

Step 3: Pass the Dealer License Test at Your Nearest DMV Licensing Office

Step 4: Determine Your Business Corporate Structure

Step 5: Set Up Your Business Corporate Structure and Complete the Required Documents

Step 6: Obtain Your Federal Employer Identification Number (FEIN)

Step 7: Apply for a Business Bank Account

Step 8: Obtain Seller’s Permit from the California Department of Tax & Fee Administration

Step 9: Register with the California Secretary of State or County

Step 10: Find a Dealership Location and Display Lot

Step 11: Install a sign

Step 12: City Business License

Step 13: Obtain a Dealer Surety Bond

Step 14: Submit Application Through the Online Form

Step 15: Complete Live Scan Fingerprinting

Step 16: Schedule and Accommodate a Site Visit by the DMV Inspector

Step 17: Receive your approved application in your mail. Now time to celebrate!